EDiscovery Trends Show Continued Burnout Despite Strong Hiring

TRU Staffing Partners

July 16, 2024 at 8:30 AM

Eye on ESI for July 2024 brought the new trends everyone was waiting for in the ESI marketplace. TRU Founder and CEO Jared Coseglia and ACEDS VP Maribel Rivera discussed the shifts, changes, surprises, and predictions for job seekers and employers in the current eDiscovery job market.

Coseglia: The free 2024 eDiscovery Jobs Report is still available from the TRU website, though the data in the industry changes monthly, information in this report remains timely and relevant. It’s a great resource, particularly for hiring managers looking for advocacy and points of data in the job market to help get the budget for hiring or to creatively help solve roadblocks to hiring.

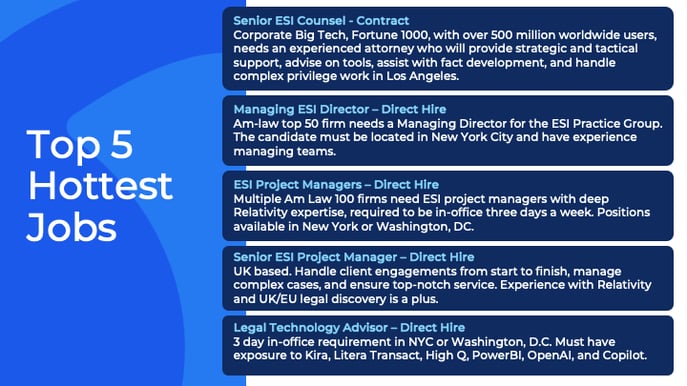

We’ve added a new segment to this webinar to show everyone the diversity of some of the hot jobs that are out there right now. There are contract, direct hire, and leadership opportunities as well as traditional midmarket project management roles. And note that at the bottom, we’re starting to see the emergence of new types of roles around emerging technologies, such as using eDiscovery technology for purposes other than eDiscovery. If any of these roles speak to you, please reach out to us.

Here are the main trends from June:

Compared to last year, TRU recruiters have filled 30% more jobs in the first half of this year than we did in the first half of last year. That shows you that organizations are hiring more, hiring quickly, and it shows that there were more jobs available this year in eDiscovery than there were at this time last year.

June stood out as another month where many job seekers declined a high number of offers. This is important because the most sought-after job seekers are getting multiple offers at the point of hire. That means one employer will be happy and three or four employers will be disappointed. And per the last point on the slide above, it is slowly becoming a candidate’s market again after so stringently being an employer’s market for the past 18 months.

The third trend is a shift toward more corporate eDiscovery hiring, however, most of this is contract work. It may be perpetual and is most frequently remote. If you are looking to get in-house within a corporate environment, sometimes going contract or contract-to-hire is the best option. TRU is seeing people leave full-time positions for these coveted corporate roles. Corporate roles offer a more unique environment and the opportunity to wear many hats in a smaller ecosystem.

Another very important trend in June was that more law firms moved from a three-day to a one-day a week in-office requirement. This signals that law firms know they need to be more flexible in order to attract top-notch talent. The minute that law firms make that shift, the number of interested candidates in open roles increases tremendously.

Interestingly, three out of four ESI job seekers would rather take a fully remote contract job than a direct hire role with a three-day or more in-office requirement. We’re finding it is more likely that an eDiscovery pro will leave a full-time role and go to a remote contract role instead of going into an office – this shows you the current mindset of job seekers.

At the end of Q2 2024, burnout is now the No. 1 motivator to move eDiscovery professionals to the marketplace for new roles. The trend started in Q4 2023 and has continued to work its way up. Organizations continue to be understaffed, teams are overworked, and this is why people are holding firm onto remote work. It gives them some control over their careers. This trend is really affecting the industry overall. People are willing to leave tens of thousands of dollars behind and go to a lower-paying contract role because they are burned out and need a change.

Also, as of the end of June, ESI attorney hiring hit a 12-month high. It’s not a technologists’ marketplace anymore. There is a big demand for ESI attorneys to negotiate, advise and litigate key ESI issues. Organizations are seeking lawyers with deep understanding of case law and how to argue case law to avoid certain consequences judicially. It’s not about running big-scale doc review.

Moving forward, I want to show you some of the data points that have changed in the last month. Offer acceptance likelihood was one of the most dramatic changes. You can see that right now, employers have only a 50% chance of getting a first offer accepted. Candidates are waiting weeks to see how many offers they get and what their best offers are. It’s no longer about being fast and first with an offer, right now, you have to put your best offer forward to get the best candidates. The lack of volume of people with a lot of open jobs is starting to hit – as you can see, it’s a trend a lot like in 2022.

Above, you can see the contract vs. direct hire trend based on offers accepted. In June, we went from a 50-50 split to more direct hiring. This shows you the demand for direct hires is increasing. We expect this trend to stay the same between now and the end of the year. However, the only thing that would change that prediction is if project work becomes extreme, you will see contract work percentages go higher because staff would be needed to fill roles for a period.

Above, you can see the contract vs. direct hire trend based on offers accepted. In June, we went from a 50-50 split to more direct hiring. This shows you the demand for direct hires is increasing. We expect this trend to stay the same between now and the end of the year. However, the only thing that would change that prediction is if project work becomes extreme, you will see contract work percentages go higher because staff would be needed to fill roles for a period.

Motivations for job seekers is always an interesting slide. Forms of burnout land in Nos. 1 through 3. Burnout means a lot of different things for ESI pros. It can mean people are overworked or overstressed. In terms of the second point, not being able to take new business affects the huge number of sales professionals coming to TRU looking for new roles. If organizations can’t take on new jobs, sales pros will want to move on to continue to make money. In terms of the third point, a toxic culture can creep in because of a lack of vision or a lack of empathy toward employees.

Above is the money slide and we have changes here to highlight. We’ve seen the salary averages go up quite a bit at law firms, across the board in the mid-market section. This shows firms are bringing up their salaries to lock down talent.

On the vendor side, it's a bit different.

We’re seeing the salaries for some roles go down, while salaries for review managers are going up – mainly because there are fewer review managers out there. Vendors want more sophisticated leadership over their reviews and are willing to pay for it. They are also pushing hard for less expensive mid-market talent.