April 2024 Eye on ESI Shows Uptick in RelOne Needs, Plentiful Contractor Work, & Surge in Law Firm Hiring

TRU Staffing Partners

April 16, 2024 at 8:33 AM

The ediscovery job market is picking up in Q2 after a slower job market in March. This month’s Eye on ESI brought together ACEDS President Michael Quartararo and TRU Staffing Partners’ Founder and CEO Jared Coseglia for a lively conversation about all things related to jobs in the ediscovery industry.

Coseglia: All the data we’ll be discussing today can be found in TRU’s 2024 EDiscovery Jobs Report, which has been available since January. The report can be downloaded for free from TRU’s website, here.

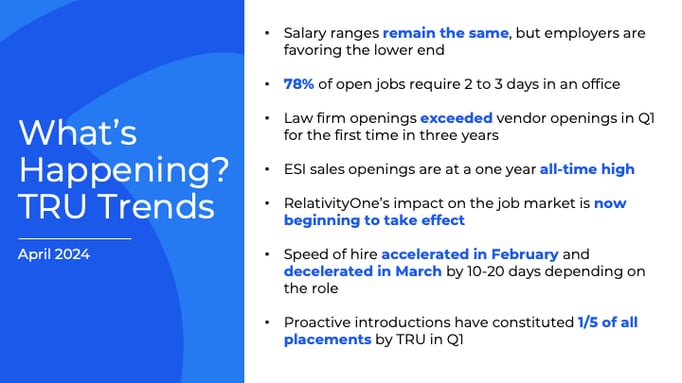

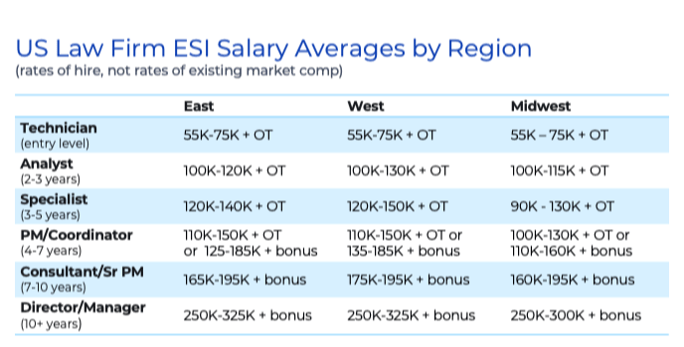

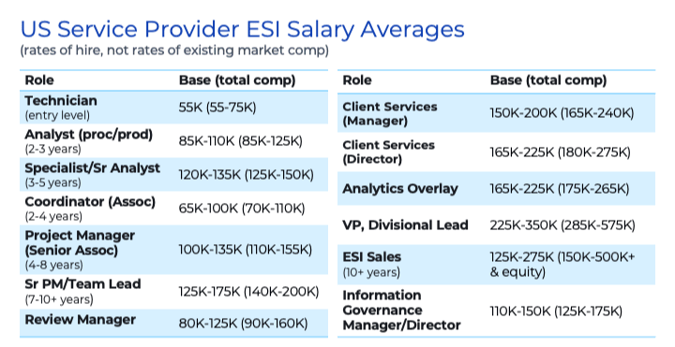

Coseglia: What I love about today’s webinar is that it’s the first webinar of Q2, which means we have new data to share with everyone. Today you’ll see what’s happened in the first quarter of 2024 for the ediscovery job market. Note that salaries are more or less the same, but employers are clearly favoring the lower end of the salary range. We haven’t seen any real upward mobility in salary in about six to eight months.

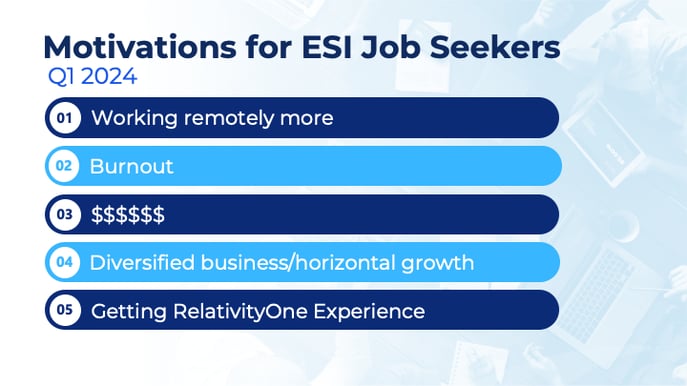

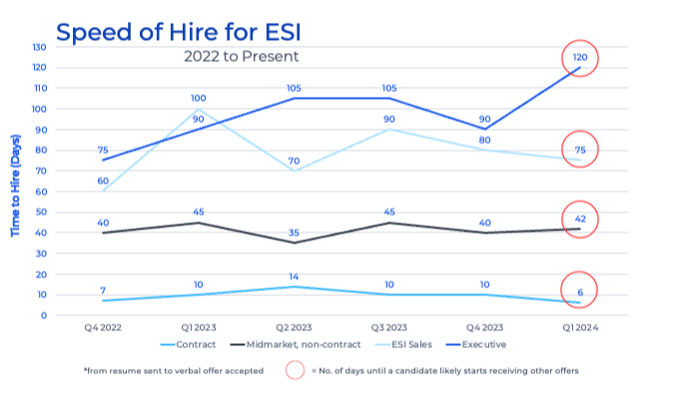

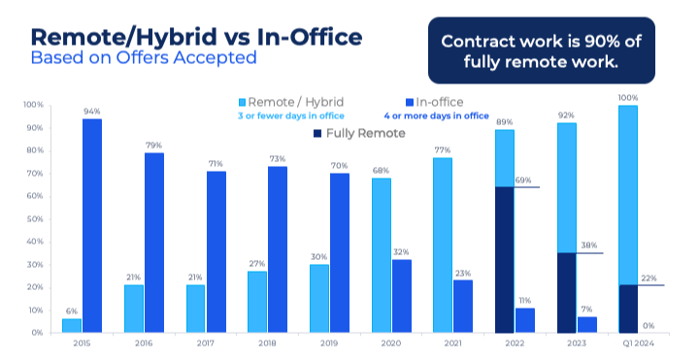

Now for a dramatic shift: 78% of open jobs require two or three days in an office, which is the new normal regardless of role. The number of fully remote jobs available has dropped considerably. This is important because the number one motivator for changing jobs is to work remotely, and right now those kinds of jobs just aren’t out there. This means two things: it’s going to be harder to fill jobs requiring an in-office presence, and if an employer has a fully remote opportunity, you are going to get a significantly higher number of job seekers showing interest in your position. Therefore, the timeline you have to move on the job seeker is significantly shorter because there are fewer fully remote opportunities and people are working their way through processes much faster.

Quartararo: This is true of all industries per the first two bullets on the chart below, right Jared?

Coseglia: Yes, true of all industries. I’ve decided that the next two years should be called the Buy-Back Years. All these companies are buying back their own stock to increase their value and there’s less investment in their human capital infrastructure. So they are hiring at lower wages to save money.

Most ESI talent in law firms and vendors are billing their hours to build the businesses, which creates stability and financial success. For the first time in three years, Q1 in 2024 saw law firm hiring exceeding vendor job openings. The reason why law firms are hiring is the uptick in the need for candidate expertise in RelativityOne. Law firms have now bought RelOne instead of farming out that work to vendors and are staffing to meet admin and processing roles to support it. There are also far fewer jobs at vendors — they are in money-saving mode.

Quartararo: Can you highlight what some of those new roles are? What’s of interest out there?

Coseglia: Part of the movement is in the attorney segmentation of the business, where they are segmenting some of the skillsets. For example, some folks are being called upon to do pre-discovery work like interpreting subpoenas. Then you have people executing the reviews and the processes. Those roles used to be combined into one role but there is enough work now to keep these roles separated.

Here are the top five motivators from Q1 — and these have changed pretty dramatically. Everyone stills wants to work from home more. You’ll see from the chart below that number two, burnout, has moved up from number five and we believe it will eclipse wanting to work more from home very soon. Organizations are understaffed, people feel undervalued, people are not as focused on money as they once were. If burnout isn’t addressed, you will start to see more aggressive turnover. We are also seeing that diversifying experiences is important to people, such as horizontal growth. Lastly, if people can’t get RelOne experience at their current jobs, they are looking to move to a role that offers that type of career-enhancing opportunity.

Here you can see that we’ve broken down the speed of hire. In hiring contract and sales roles, it has accelerated, while in the others, it has remained the same.

In remote versus hybrid, you can see the decline in the number of fully remote roles. And it’s interesting to note that in Q1, TRU did not place a single candidate in a role that required full-time in-office presence. Most of the fully remote roles available are contract work. Also, most of the fully remote jobs in the industry are with vendors and they aren’t hiring that much right now.

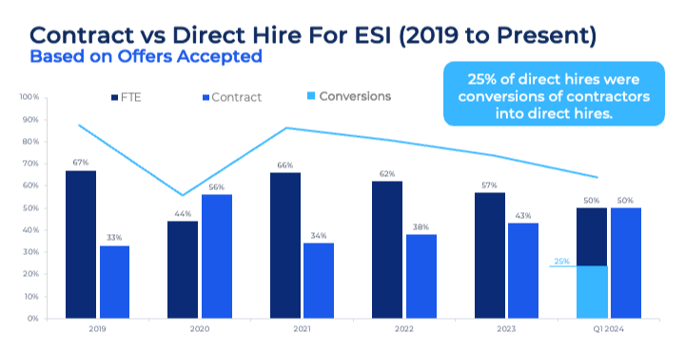

In contract versus direct hire, it’s interesting to note that there are an even number of contract jobs as regular full-time roles. However, 25% of direct hires came from converting contractors to full time. So, getting a contract position is sometimes the best way to work out a role. For hiring managers, it’s a great way to get buy-in to hire someone after they have proved themselves. Or the contractor finishes the role and moves on to another one having gained the experience from the previous role. It works out for everyone.

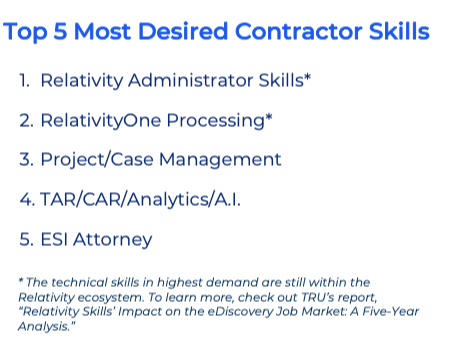

Here are the top five things customers ask for when they hire contractors. Relativity administrator skills are at the top, following by processing skills. The ESI attorney roles consist of building workflows or teaching A.I. models.

Here are the salary averages. They haven’t really changed. Employers are favoring the low end, but we did see an uptick in director/manager salaries at the end of last year, so these are slightly higher. We think these numbers might tick up a little bit in the next quarter. I do think the ESI sales numbers will go up. We’re starting to see some big players make moves that will raise that $275k considerably.

If you are one of the job seekers looking for new, diverse work experiences, or an employer trying to streamline workloads and prevent pro burnout, look closely at these industry trends and start making your move now. Reach out to TRU Staffing Partners to get started today.

Did you miss the live broadcast of this webinar? Watch the full recording, here.

Just want the monthly compensation metrics? Download the monthly proprietary compensation metrics deck, here.